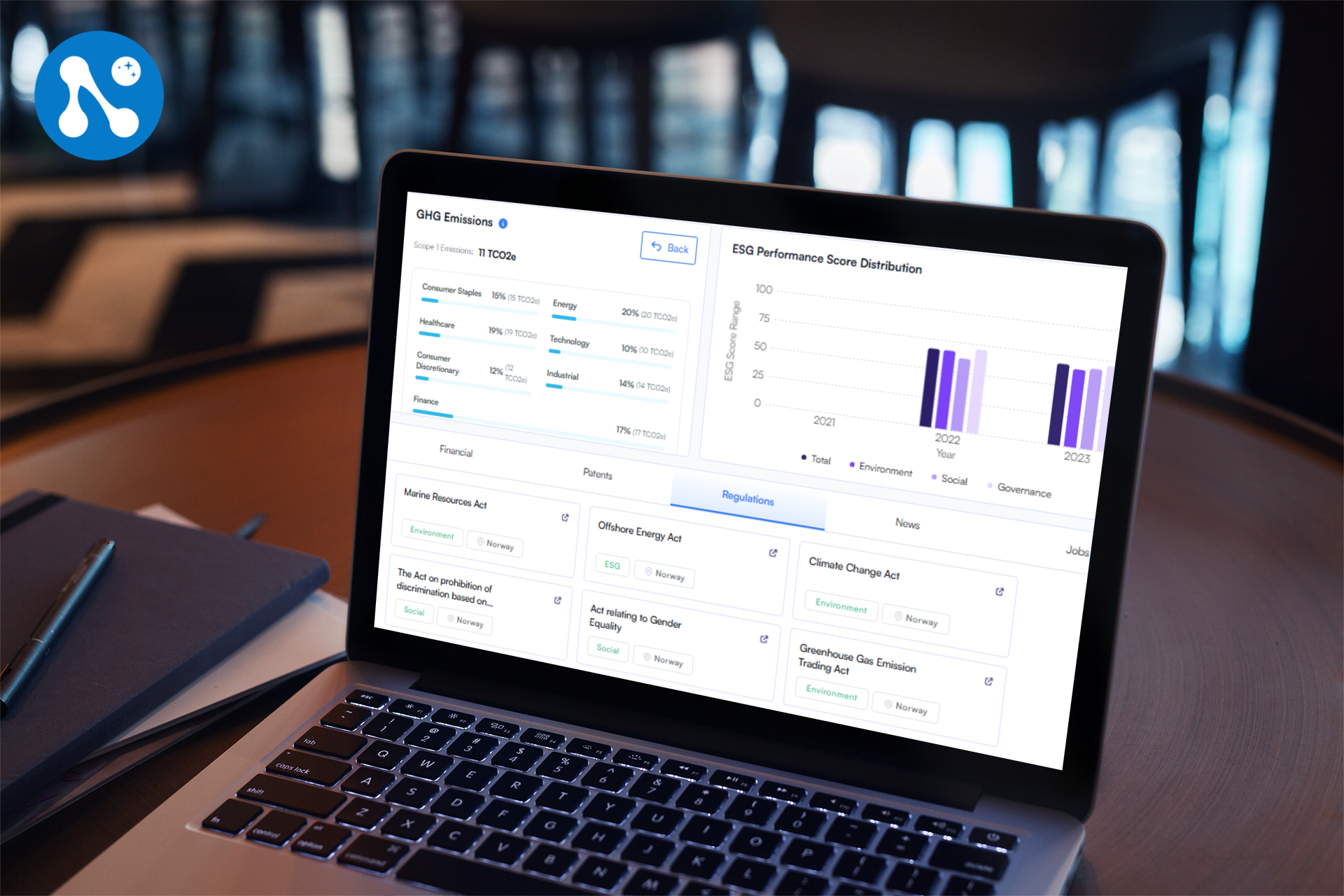

The ESG Data Platform for Private Markets: Patents, Regulations, Jobs, News, and Private Company Fundamentals

Unlock real-time ESG analytics for every region, deal, and portfolio. 5,000+ private companies, 90+ countries, 1,000+ sub-national jurisdictions. Trusted by top PE, VC, and asset managers.

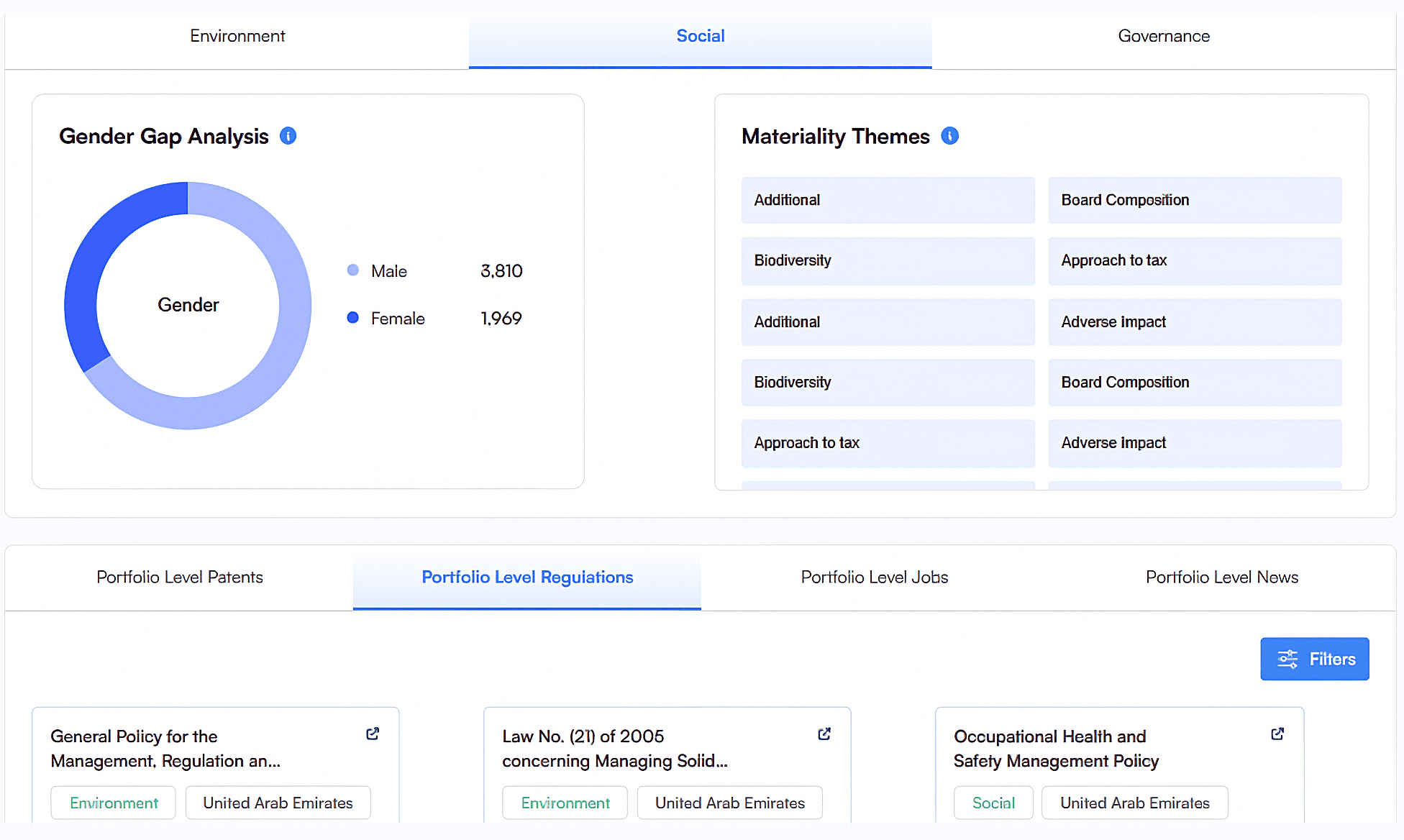

Explore Our Five Proprietary ESG Data Streams

NeoImpact is the only global alternative data platform for private market ESG, delivering actionable insights to investors who demand comprehensive data without silos.

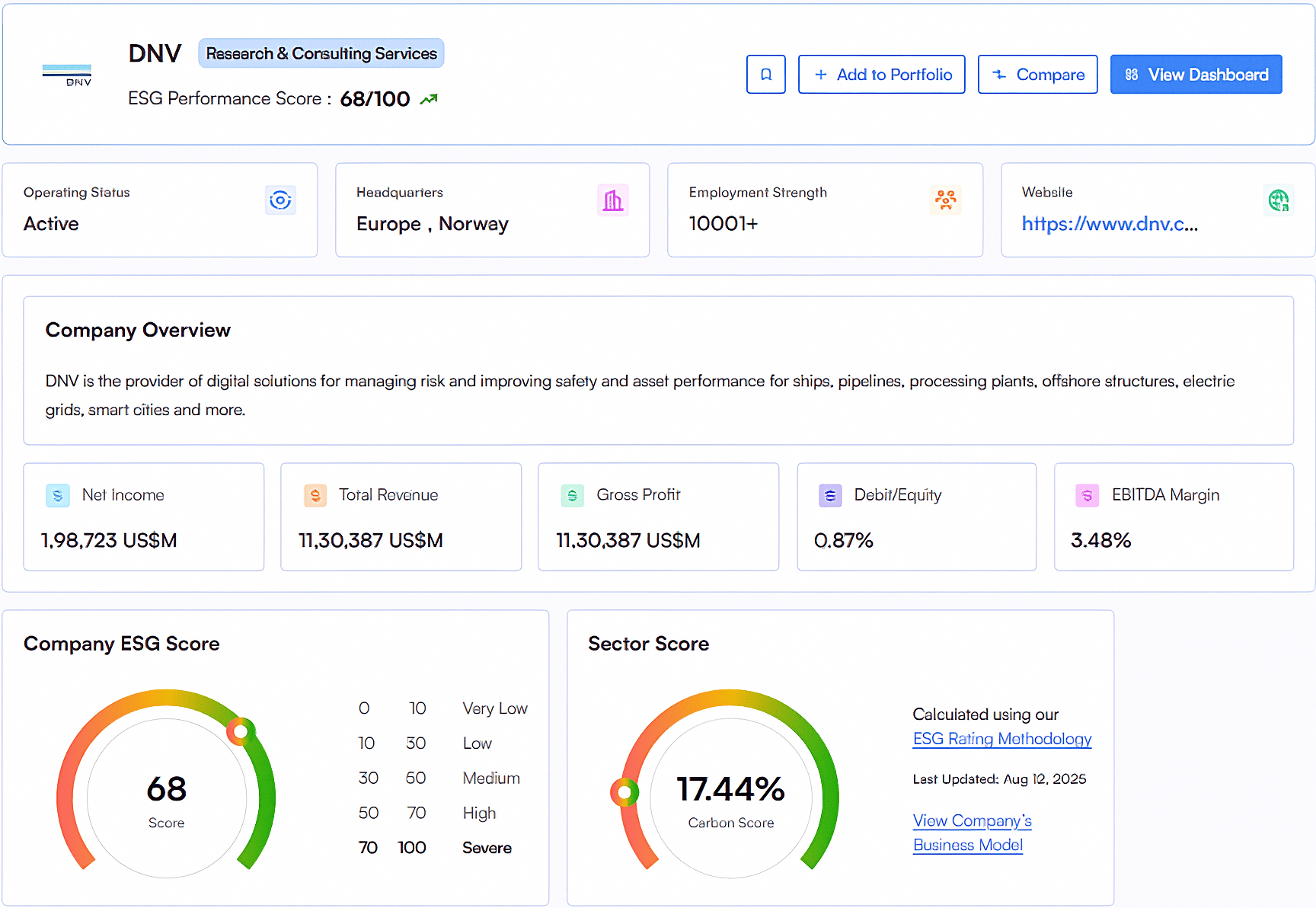

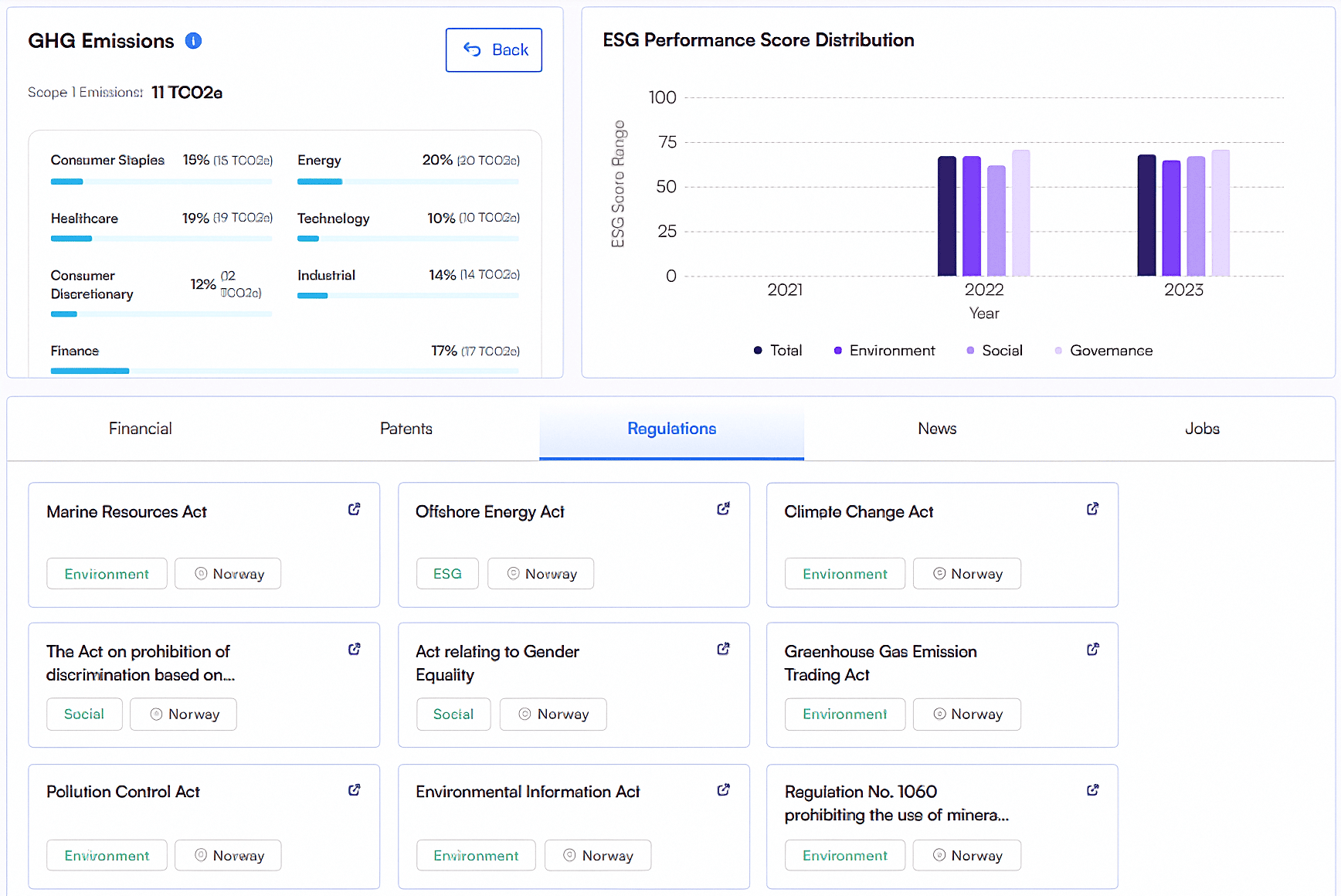

Private Company ESG Data

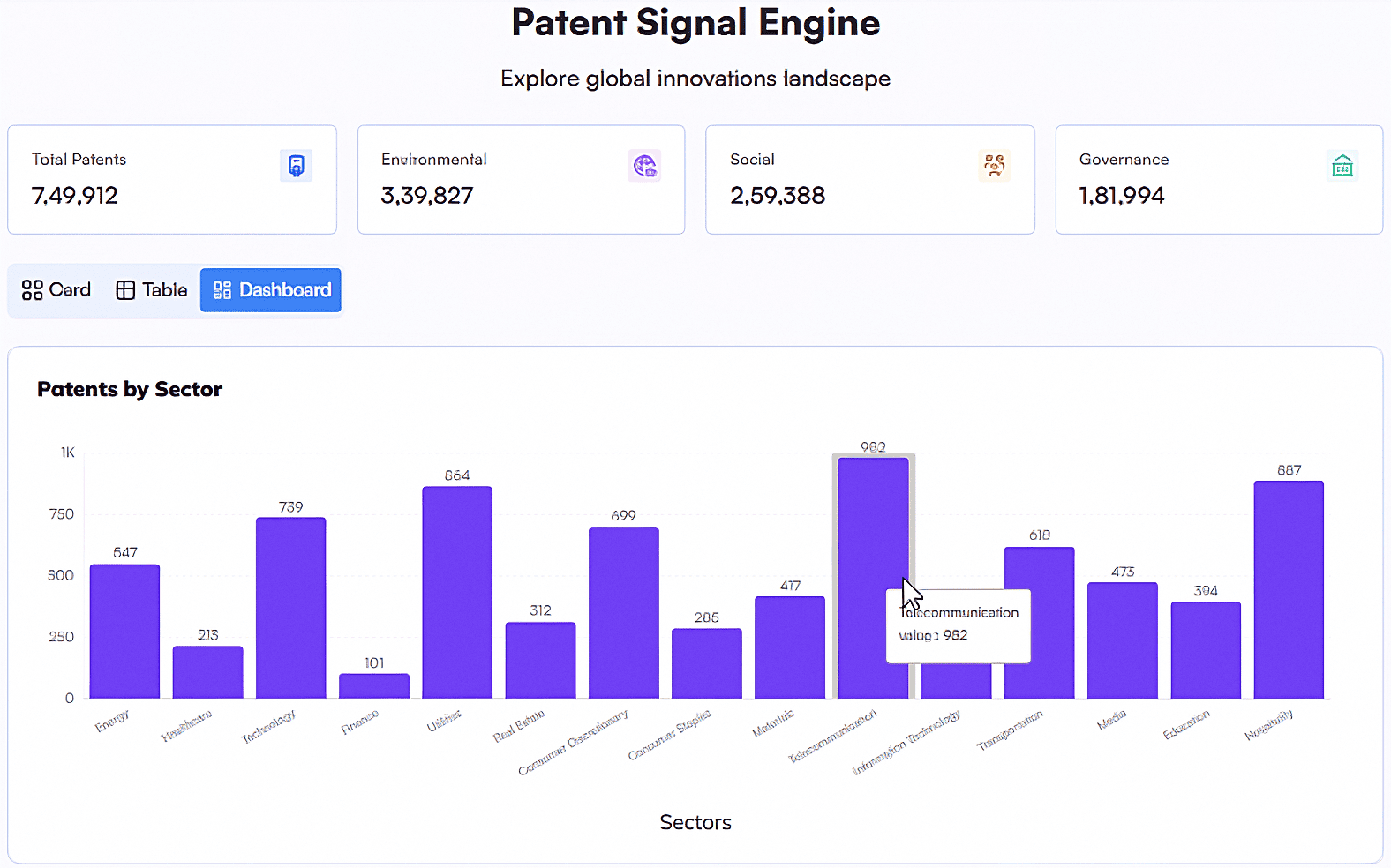

ESG Patent Analytics

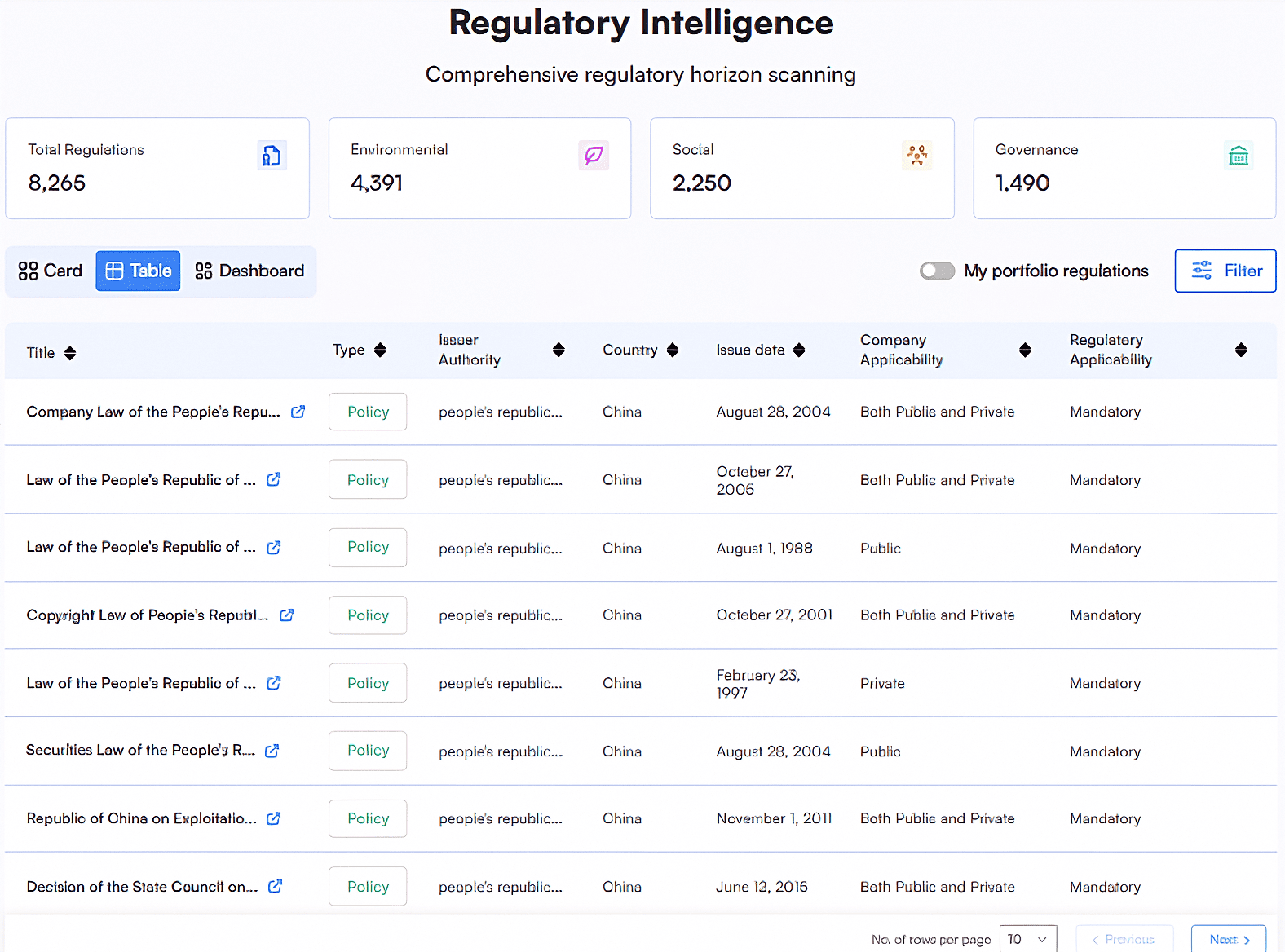

ESG Regulatory Tracker

ESG News & Risk Alerts

ESG Jobs & Hiring Trends

Unmatched Global and Regional ESG Data Coverage

Track ESG metrics, patents, jobs, news, and regulations across 5,000+ private companies, with market-leading depth in the US, UK, Germany, France, India, and all key global regions.

Stay compliant with every major framework—from SEC and CSRD to BRSR and GRI—with customizable reporting for each market.

*Data refreshed monthly or annually, with archives and real-time feeds—trusted by global PE, VC, credit, and infra investors.

Global Insight. Private Market Focus.

Unlike generic ESG providers, NeoImpact is explicitly built for private market investors, offering specialized data streams that deliver both alpha-generating insights and compliance automation.

Global Reach

Alternative Data Focus

Private Markets Only

Modular & Flexible

Enterprise-Grade Security

Tailored Solutions for Every Investment Role

From deal screening to portfolio monitoring and compliance reporting, NeoImpact delivers actionable ESG intelligence across the investment lifecycle.

For PE/VC Firms

- Accelerate ESG deal screening with automated red flag detection

- Benchmark portfolio companies against industry peers

- Identify ESG improvement opportunities with quantifiable ROI

- Track sustainability performance across holding periods

For LPs & Asset Managers

- Portfolio-wide ESG risk monitoring across managers

- Cross-market compliance verification for global portfolios

- Evaluate GP sustainability commitments with objective data

- Generate LP-ready reporting with minimal manual input

For Compliance Teams

- Automated BRSR/SFDR/CSRD reporting workflows

- Real-time controversy and regulatory risk alerts

- Audit-ready documentation and data provenance

- Climate scenario analysis with regional variation

Get In Touch and See NeoImpact in Action.

Experience how NeoImpact transforms ESG analysis for private market investors with a personalized demonstration tailored to your investment strategy and portfolio needs.

During your demo, our team will:

- Walk through all five data streams with examples relevant to your investment focus

- Demonstrate integration capabilities with your existing portfolio management systems

- Show how peer firms are leveraging our platform for both compliance and alpha generation

- Provide a sample report based on your actual portfolio companies (with your permission)